Third Quarter, 2024

Click here for a printable version of the Investment Update.

Stock indices reached new highs in the third quarter as the Fed announced its first rate cut since its battle with inflation began in 2022. While U.S. equity markets appear priced to perfection, we continue to be excited by opportunities in many of our investment themes.

A WILD RIDE ENDS WITH GAINS

After a sharp drop early in the third quarter, the S&P 500 rebounded to all-time highs by quarter end. So far this year, the Index’s total return is a strong 22.1%. The MSCI All Country World Index (ACWI) also reached new highs in the quarter and has returned a solid 19.1% year to date. Driving the market rebound were continued signs of moderating inflation coupled with solid economic growth, which increased investor optimism that the U.S. Federal Reserve would achieve a “soft landing,” taming inflation without triggering a recession. That sentiment was bolstered in mid-September when the Fed cut its target interest rate by 50 basis points to a range of 4.75%-5.00%. This emphatic shift signaled Fed confidence that the inflation beast has indeed been slain.

AI: THIS TIME REALLY HAS BEEN DIFFERENT – SO FAR

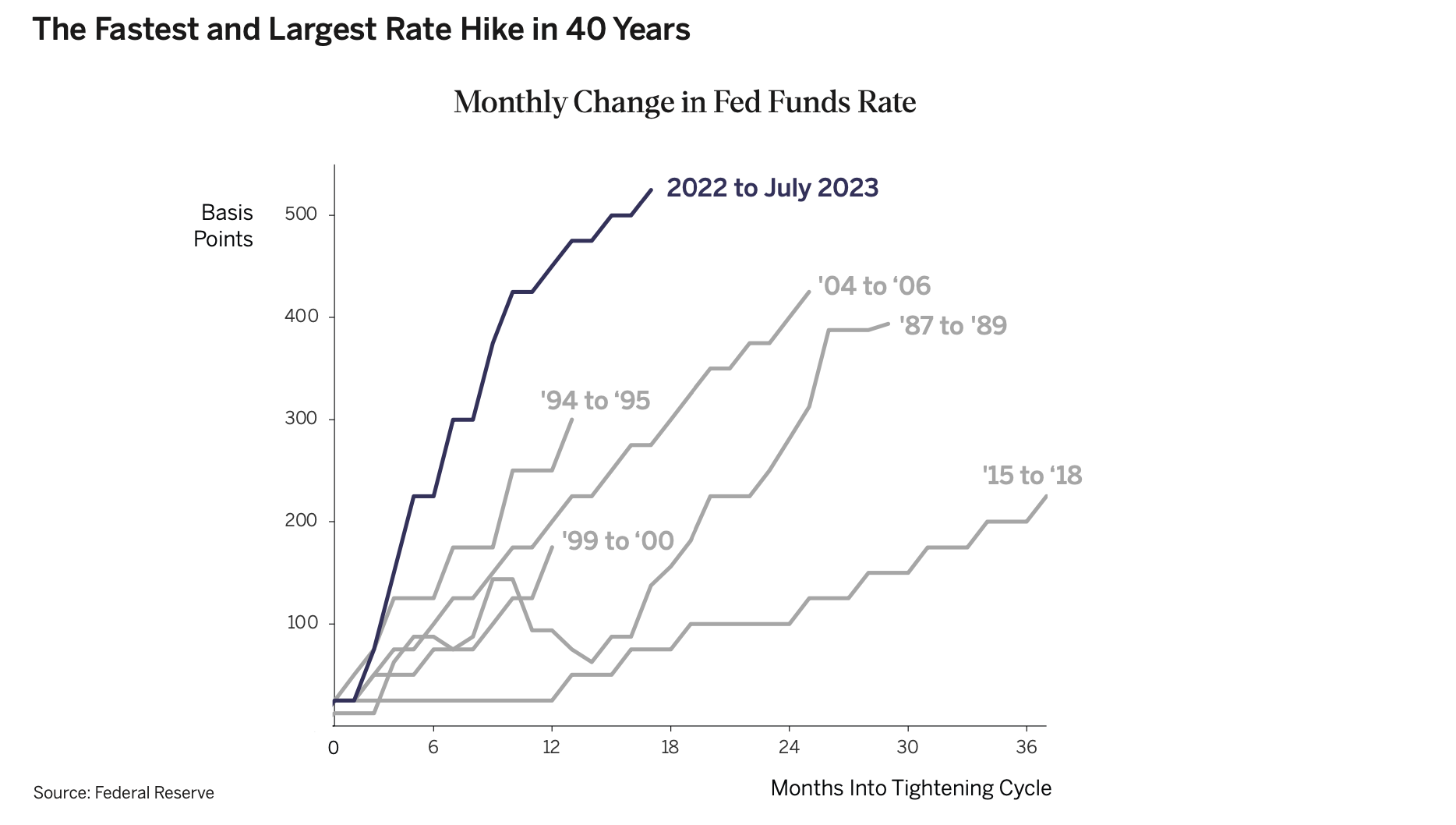

Given that the Fed raised interest rates more and faster this time than in any cycle in the past 40 years, it is stunning that economic growth merely slowed.

Four unusual conditions allowed the U.S. economy to avoid the widely expected recession and powered strong equity market performance over the last two years.

- Abundant Ultra-Low-Cost Debt: Burned by the liquidity squeeze of the Global Financial Crisis of 2008-09, consumers and corporations took advantage of a decade of near-zero interest rates to lock in long-term, fixed-rate debt at very low interest rates. As a result, many businesses and consumers didn’t need to borrow, which significantly dampened the impact of recent rate increases.

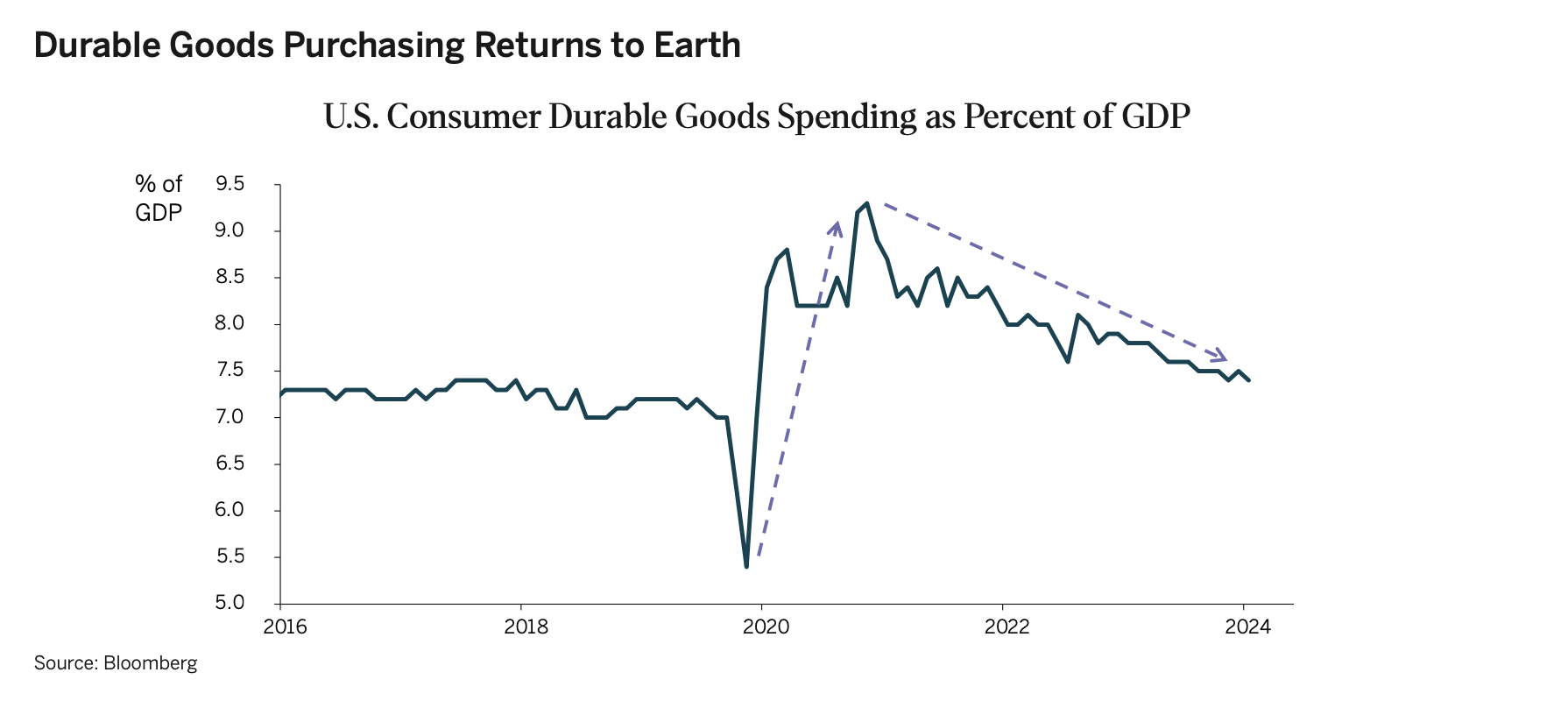

- Consumers Primed to Spend: Having amassed a staggering $2.1 trillion of excess savings during the pandemic, U.S. consumers had ample resources to spend more than their incomes alone would support. This spending spree helped forestall recession. Today, every income cohort – not just wealthy households – remains better off in inflation-adjusted terms than before the pandemic. Nonetheless, consumer spending may slow. Pandemic-era savings are largely depleted, and the savings rate is near historic lows. And, after gorging on big-ticket purchases in 2021 and 2022, U.S. consumers may have sated their appetite for new cars, home-entertainment systems and fitness equipment. Fed rate cuts may not be enough to spur a big increase in spending, as they have in the past.

- A Labor Shortfall: Usually, the Fed raises rates to cool inflation after labor supply has grown to meet strong demand. But the rate hikes that began in 2022 followed two years in which the pandemic had dramatically reduced the U.S. workforce. Roughly one million people in the U.S. died, many more retired earlier than expected, and immigration effectively ground to a halt. As a result, the economy reopened with a labor shortage – the first since World War II – and wages rose as employers competed to attract scarce workers. As people slowly returned to work and immigration resumed, the labor force increased, leading to stronger-than-expected economic growth.The Fed rate hikes of 2022 and 2023 did reduce the demand for labor, but with the total labor supply still below its pre-pandemic level, the unemployment rate remained very low. It began to inch up this past summer, however, indicating that labor supply and demand might be nearing equilibrium. From here, a further drop in demand for labor could meaningfully increase joblessness. We believe this was the main reason the Fed chose to cut interest rates in September.

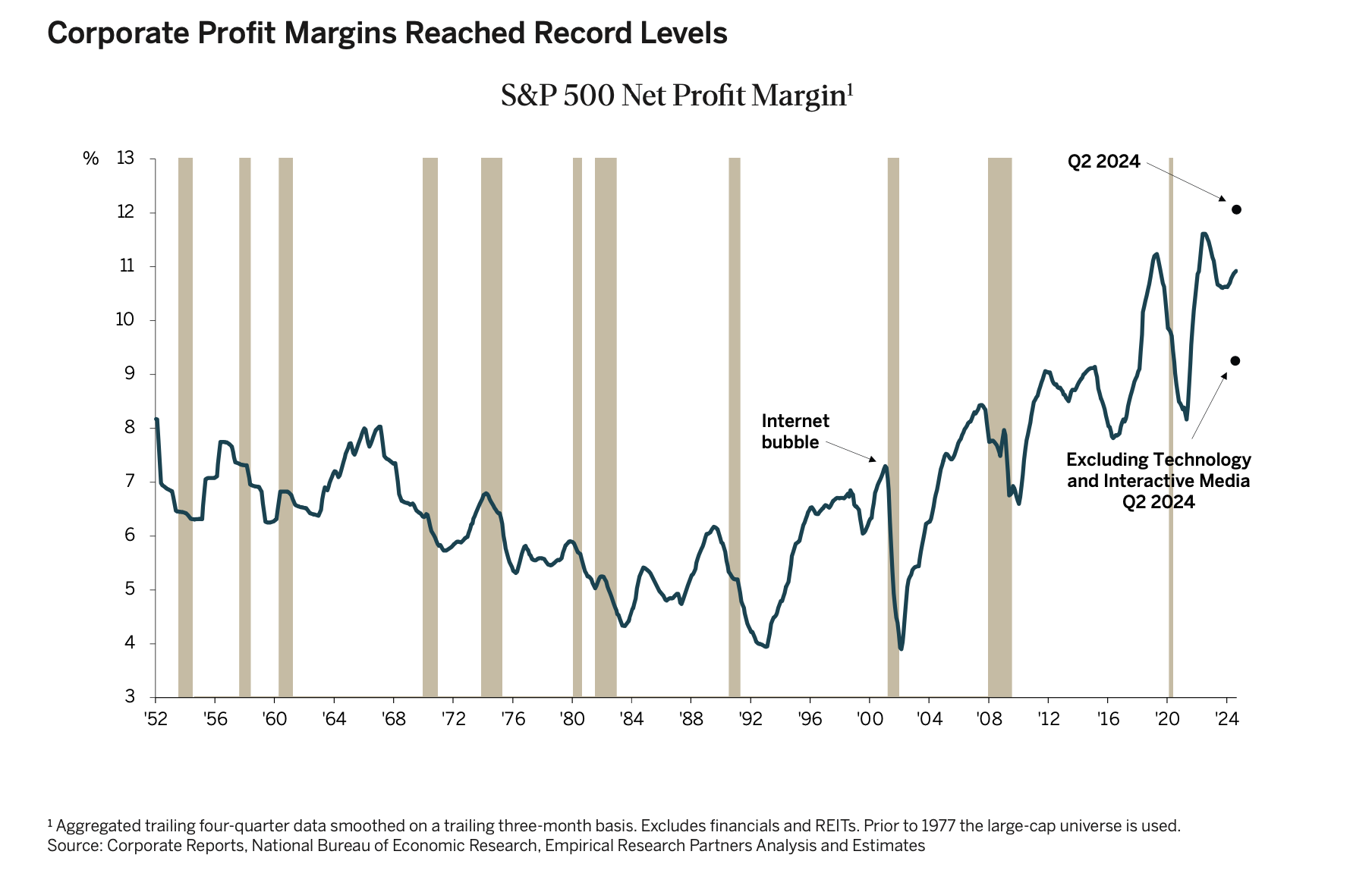

- Strong Corporate Profits: With high cash levels and long-term debt locked in at very low rates, U.S. company profitability and free cash flow generation remained extremely strong, despite rising interest rates. The S&P 500’s profit margins hit a record 12% in 2024’s second quarter and are now two points above their 2019 level and more than double their high during the Internet bubble in early 2000.

PRICED TO PERFECTION IN AN IMPERFECT WORLD

Monetary policy works with long and unpredictable lags. Even after the September cut, interest rates remain high, and economic growth will likely continue to slow. We believe that each of the four favorable conditions discussed above is fading. The pace and magnitude of the Fed’s monetary policy easing will be crucial to averting a recession. We see three additional risks that investors must weigh.

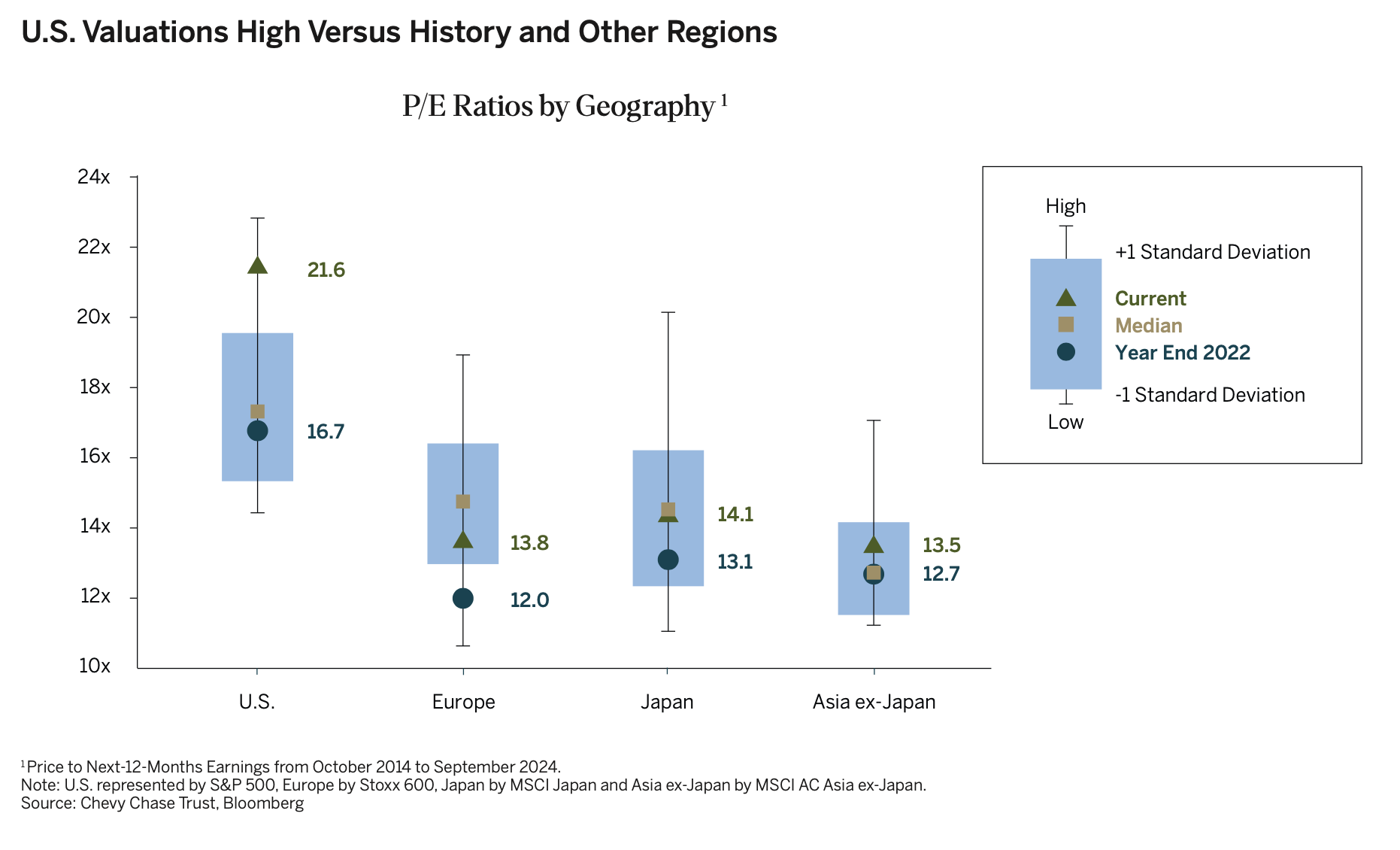

- A Dangerous Combination of High Expectations with Slowing Growth: The S&P 500 soared 36.3% over the past 12 months, mostly due to expanding price-earnings multiples. Actual earnings growth drove only one quarter of the index’s rise, with multiple expansion accounting for the rest. At 21.6 times forward earnings, the S&P 500 is more expensive than it has been 96% of the time since 1962. Such high valuations reflect high expectations for the economy and corporate earnings. Current consensus expectations call for S&P 500 earnings to increase roughly 15% next year, more than double the long-term average of about 7%. It is hard to see how many companies will achieve such results, with revenue growth likely to slow and margins already near record highs.

- Artificial Intelligence Yet to Prove Itself: Most of the gains in the S&P 500 this year were generated by a narrow group of tech companies, most of them related to artificial intelligence (AI). While their profitability and cash flows have been strong, there are clear signs of froth and FOMO (“fear-of-missing-out”) by both companies and investors. Over the past 12 months, investors have poured roughly $27 billion into technology-focused exchange-traded funds (ETFs), while non-technology sector ETFs have had outflows of $6.6 billion. At the same time, capital spending by many of these companies is increasing at a significantly faster rate than sales or earnings growth. If this continues, free cash flow will decline, and investors may be disappointed. Real-world experience does not yet support the AI mania. Hundreds of millions of people have tried ChatGPT, but most haven’t stayed with it. Almost every big company has an AI pilot project of some sort, but few are deploying AI commercially. Perhaps it is just a matter of time before AI proves out, but the short-term outlook is questionable. According to a recent article in Forbes: “77% of Employees Report AI Has Increased Workloads and Hampered Productivity.”

- Commercial Real Estate in Distress: Office vacancy rates are at an all-time high and are still trending upward. Default rates are climbing in the office, apartment, retail and hotel segments. Regional banks, which account for the bulk of lending to the sector, are likely to experience more losses. Lower interest rates will certainly help, but it is unclear whether they will fall fast enough and soon enough to reverse recent trends.

PORTFOLIO STRATEGY

Given our long-term orientation, we haven’t changed our equity portfolio positioning substantially over the past quarter. The frenzy around AI continues to monopolize a disproportionate amount of investor attention. Meanwhile, our equity investment themes have quietly continued to unfold.

Next-Generation Automation: Several years ago, apparel manufacturers were the first industry to adopt ultra-high frequency RFID technology on a large scale. They used the wireless reading capability of these battery-free semiconductors the size of a grain of sand to seamlessly track inventory in their complex supply chains. Now, major logistics companies, such as UPS, are deploying the technology to track every package shipped and ensure the right parcels go in the right vehicles. Initial deployments have significantly improved efficiency and reduced misloads by more than 60%. The food and grocery industry may be next. Wireless tags, cheap enough to be placed on individual items, can allow automatic tracking of expiration dates and inventory levels, reducing spoilage and keeping shelves fully stocked. Widespread adoption in food and grocery would increase the market size many times over.

Advent of Molecular Medicine: We have long seen the clinical and commercial potential from customized healthcare treatments based on unique aspects of patients’ conditions. We are excited to see these capabilities moving into broader clinical use. Last quarter over 40% of oncologists ordered a Signatera test to help determine the optimal treatment regimen for their patients. This test was only introduced for clinical use in 2019. This rapid adoption of a molecular test reflects its ability to detect cancer recurrence months before standard imaging techniques, thereby improving patient outcomes.

Opportunities Abound Abroad: For reasons we have discussed in previous Investment Updates, we continue to believe non-U.S. equity markets trade at more attractive valuations than domestic equities. U.S. equities now account for almost two-thirds of global market capitalization, while the U.S. economy makes up only a little more than a quarter of global GDP and the U.S. has just 4% of the world’s population. Some of the geographic dispersion in P/E multiples is due to the composition of the indices, with the tech-heavy S&P 500 more expensive than the European Stoxx 600, which has greater representation in lower-valued sectors such as automobiles, energy and financials. However, even on a sector-by-sector basis, companies domiciled outside the U.S. are trading at more attractive valuations than their U.S. competitors, often despite comparable growth rates.

SIGNIFICANT PORTFOLIO ACTIONS IN THE 3RD QUARTER

Banco Santander, S.A.

During the third quarter, we initiated a position in Banco Santander, S.A., the Spanish multinational financial services company, as part of our Opportunities Abound Abroad theme. Santander trades at a considerable discount to U.S. peers, despite competitive business metrics. We believe their significant exposure to Latin America via Brazil provides an opportunity to participate in high-margin, underpenetrated markets, while continuing to grow their core businesses in Europe and North America. Furthermore, Santander stands to benefit from structural reforms in Europe aimed at enhancing the region’s competitiveness through increased integration and reduced regulation.

ChampionX Corporation / SLB

During the third quarter, we exited our position in ChampionX, an oilfield technology solutions company, which was part of our End of Disinflationary Tailwinds theme. It was announced in early 2Q24 that ChampionX would be acquired by SLB, another holding within the theme. Proceeds from the sale were used to meaningfully increase our position in SLB, the world’s largest oilfield services company.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.